Home Loans Brokers Melbourne for Dummies

Wiki Article

10 Easy Facts About Home Loans Brokers Melbourne Explained

Table of ContentsIndicators on Home Loans Brokers Melbourne You Need To KnowNot known Details About Home Loans Melbourne Home Loans Melbourne - QuestionsA Biased View of Home Loans Brokers MelbourneHome Loans Brokers Melbourne Can Be Fun For Anyone

The very first point you need to learn about home loan broker costs is that most brokers don't charge them so you generally will not need to pay a dime. Some charge a charge for solution, as detailed in their credit rating help quote - home loans melbourne. Rather, the broker gains a payment from the lending institution or credit service provider for every financing they aid protectThe amount of cash your broker gets depends on 2 factors: The size of the lending; and, The loan to worth ratio (LVR). Your broker will certainly get a percentage based on these numbers.

Some lending institutions supply home loan brokers a route commission structure that sees the compensation rise each year. The broker may obtain no trail payment during the initial year of the financing, up to 0.

The Best Strategy To Use For Home Loans Melbourne

(So you recognize: UNO has actually damaged the web link in between the size of fundings and selection of lender/ item and staff member remuneration it is among the lots of points that makes us different from traditional brokers.)The upfront and route commission amounts that a broker expects to receive in regard to your home mortgage must be described in the Credit history Proposal Disclosure Document.If you fail on your home funding repayments, the lending institution will certainly not pay path commission to your broker. It depends on the home mortgage broker, but often, absolutely nothing.

275% of the continuing to be finance amount, plus GST, each year as trail payment. The percent your broker receives likewise depends on whether they undergo a collector or otherwise. If they go through a collector it will hinge on the aggregator's arrangement with the lending institution and in addition, the broker's contract with the collector.

Yes. A reference cost is frequently a percent of the commission gotten by the broker and is paid to the referrer. For instance, if a monetary organizer recommends their customer see a certain broker, that go to this web-site broker would certainly then pay the financial coordinator for the introduction and/or the client, depending upon the arrangement.

Some Known Factual Statements About Home Loans Brokers Melbourne

It is completely dependent on just how several loans they compose. A lot of brokers depend on commission. As an outcome, if you stray from the original funding structure you authorized up for, a lending institution will bill "clawback" charges to your broker.The clawback differs relying on the loan provider, but some repossess every one of the ahead of time compensation if the car loan finishes within the very first 12 months. This might go down to half if the mortgage finishes in its second year. The bad information is that some home loan brokers will ask you to pay this clawback charge.

Such brokers are few and far between, as the majority of locate this framework is not financially Visit Your URL feasible. If the broker does charge any in advance costs for their solution, these should be outlined in the a Credit Scores Aid Quote.

What Does Home Loans Brokers Melbourne Do?

It ought to not be counted upon to make any kind of monetary decisions., and other item info included in this write-up, are subject to alter at any time at the total discretion of each lender.

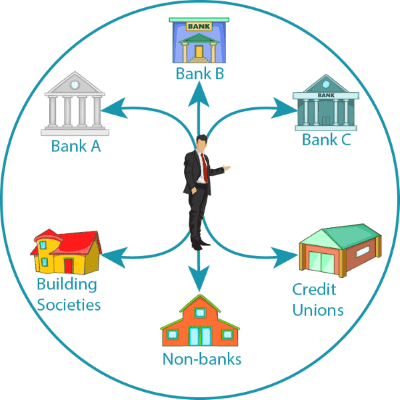

They can also put you in touch learn the facts here now with a selection of other corresponding company, such as economic organizers, real estate representatives, attorneys and residential or commercial property agents, that will likewise help you accomplish your objectives, as and when needed. To prepare for a lending application you will certainly need to supply some sustaining records.

Your broker is needed to preserve confidentiality of the info that you supply and just pass it on where essential to secure your finance or where called for by law. Your broker can also consult with you to describe exactly how attributes, fees and charges attached to your funding choices contrast and impact the total quantity you will certainly repay on your financing.

The 10-Minute Rule for Melbourne Home Loans

It's feasible, for instance, that you could be much better off changing from a variable to a set passion price finance, or changing products for a far better offer. Your broker will certainly assist you with this decision by keeping lasting contact. The more mindful you are of the assistance your financing broker has to supply in the home car loan application process, the better located you are to navigate the process comfortably and effectively.Report this wiki page